Share

Calling it a “back-door voucher plan,” educators and allies are challenging a bill introduced in the 2017 Legislature that would give people tax credits for private school tuition and allow corporations and wealthy individuals to get tax breaks for donating to private school scholarship funds.

The proposal would drain $35 million from public schools, steering the money toward private entities that do not have to serve all students, said Nick Faber, vice president of St. Paul Federation of Teachers Local 28 and an elementary science teacher for 30 years.

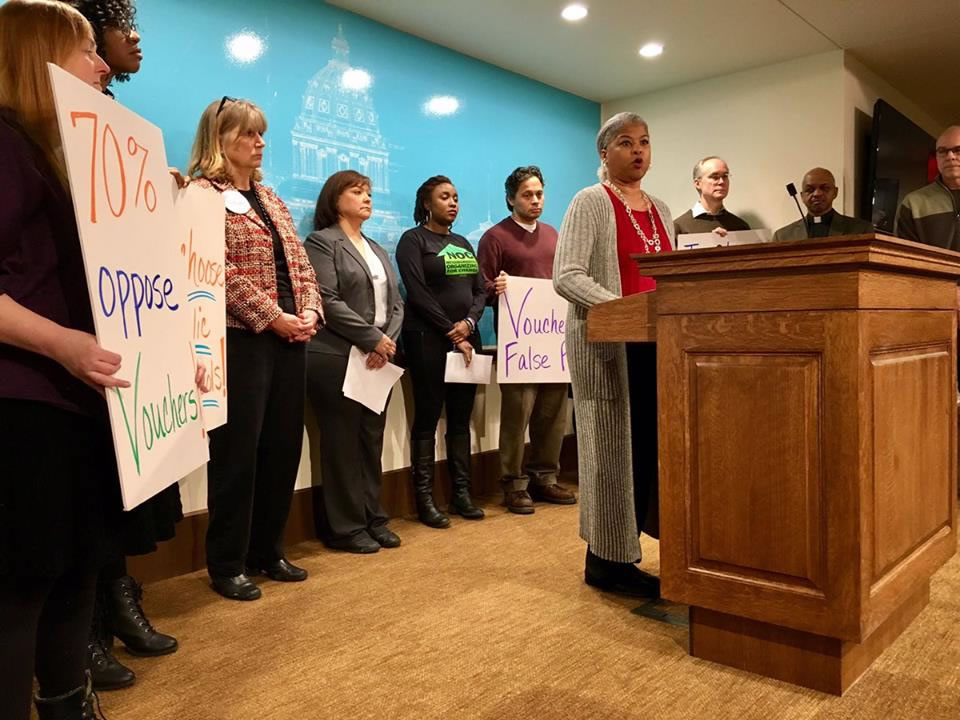

Public schools welcome students with disabilities, who don’t have English as their first language and who come from all economic backgrounds, Faber said, speaking at a news conference at the state Capitol. “Public schools are the heart of democracy because all of our students are welcome.”

Rep. Ron Kresha, R-Little Falls, sponsor of the House bill, told a House hearing Tuesday that the measure offers options and would help students who are under-achieving. “Not one penny will come out of K-12 education funding for this,” he said.

Delene Sanders, a 7th grade U.S. history teacher in Oakdale, disagreed. She said that as an African-American, she questions the “false promises” of proposals like those put forth in HF 386/SF256.

“Vouchers drain critical funding away from public schools and funnel them to private schools,” Sanders said. “Private schools are unaccountable. They operate with little oversight, few financial or academic reporting requirements or standards for teachers … Private schools can and do turn away kids. They can reject a child based on where her parents worship or because he has two parents of the same sex. That child that uses a wheelchair can be turned away . . . These vouchers lead to two-tier systems – one for the wealthy and white and one for everyone else.”

Organizations participating in Tuesday’s news conference included Education Minnesota, ISAIAH, Neighborhoods Organizing for Change and Service Employees International Union Local 284.

“We believe it [the legislation] is bad for Minnesota, it is bad for our communities and it is bad for our children,” said the Rev Paul Slack, leader of ISAIAH, a coalition of faith organizations.

So far, no votes have been taken on the legislation in the House or Senate.

This report includes information from Session Daily, a publication of the Minnesota House of Representatives.