Share

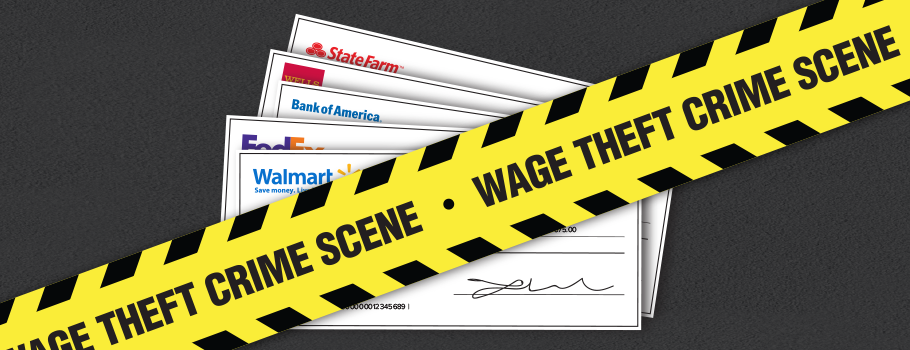

A new report, “Grand Theft Paycheck” published by advocacy nonprofits Good Jobs First and Jobs With Justice Education Fund analyzed wage theft related lawsuits and fines.

The report shows that many large corporations operating in the United States have boosted their profits by forcing employees to work off the clock, cheating them out of required overtime pay and engaging in similar practices that together are known as wage theft.

The list of the most-penalized employers includes Bank of America, Wells Fargo and other large banks and insurance companies as well as dominant technology and healthcare corporations. Many of the large corporations are repeat offenders, and 450 firms have each paid out $1 million or more in settlements and/or judgments.

“Our findings make it clear that wage theft goes far beyond sweatshops, fast-food outlets, and retailers. It is built into the business model of a substantial portion of Corporate America,” said Good Jobs First Research Director Philip Mattera, the lead author of the report.

According to the accompanying website ViolationTracker.org, the nation’s first comprehensive database on corporate misconduct, between 2014-17 Minnesota headquartered companies are well represented.

Nationwide, half of the top dozen are banks and insurance companies, including Bank of America ($381 million); Wells Fargo ($205 million); JPMorgan Chase ($160 million); and State Farm Insurance ($140 million).

Many companies accused of wage theft are highly profitable. Among the dozen most- penalized corporations, all but two had an annual net income of more than $2 billion in their most recent fiscal year. AT&T, JPMorgan Chase and Wells Fargo each had more than $20 billion in profits. These companies pay their chief executives generous salaries, bonuses, and perks. CEOs at AT&T, Bank of America, JPMorgan Chase and Walmart each receive annual compensation of more than $20 million.

“At Wells Fargo, aggressive sales quotas based on exploiting vulnerable customers forced me into 12-hour shifts with no breaks and no food allowed – and threats to withhold my paycheck if I didn’t sign off on working extra hours for free,” says Kilian Colin, who worked for the bank between 2013 and 2016 in southern California.