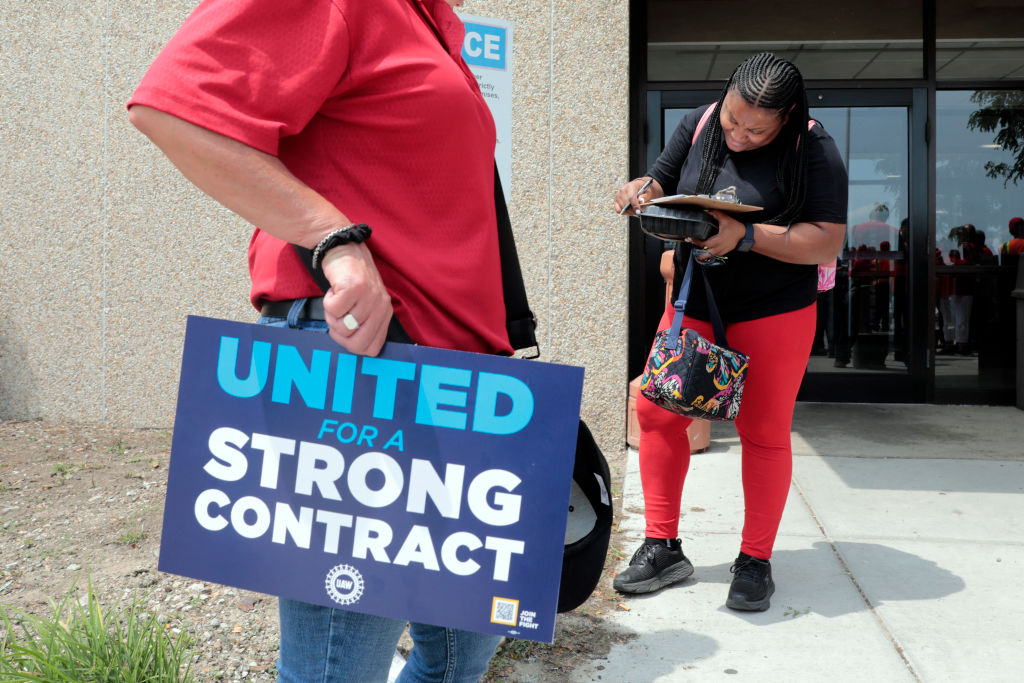

UAW workers sign UAW pledge cards as they leave their shift at General Motors Factory Zero in Detroit, Michigan, on July 12, 2023. (Photo by JEFF KOWALSKY/AFP via Getty Images)

Share

As 150,000 members of the United Auto Workers gear up for a possible strike against the “Big Three”—Ford, Stellantis, and General Motors—we are seeing the re-emergence of a well-worn media trope: fearmongering about how a collective work stoppage could harm “the economy.” This slant is common, from the media buildup to the potential rail strike to the potential UPS strike. This time, media outlets are throwing around a scary-sounding number: $5 billion.

“Auto Workers Walkout Could Cost $5 Billion in Losses to Economy, Study Predicts,” states an August 17 headline from Forbes. “Looming Auto Workers Strike Could Cost $5 Billion in Just 10 Days, New Analysis Says,” warns an August 17 headline from CNBC. This $5 billion figure was repeated in Fox Business, Reuters, and numerous other outlets. Without context, this dollar amount gives the impression that workers using their labor power to improve their lot is harmful to society, and directs the conversation away from what these workers are owed for their primary role in creating the economic value of producing vehicles.

But further scrutiny is warranted of the organization that came up with the $5 billion figure. The study was conducted by the Anderson Economic Group, an economic consultancy firm. As the Reuters article states: “The Anderson Economic Group, based in East Lansing, Michigan, on Thursday released an estimate that a ten-day UAW strike that shuts down the Detroit Three automakers could cost the manufacturers, workers, suppliers and dealers more than $5 billion.”

Anderson Economic Group released a summary of its findings, which states that the losses refer to “potential losses to UAW workers, the manufacturers, and to the auto industry more broadly if those negotiations are not successful before the current contract expires in September.” The losses also assume a strike on all three automakers simultaneously, which Anderson Economic Group’s CEO said was unlikely in a separate media briefing.

But what none of the above outlets disclose is that Ford and General Motors—two of the companies involved in negotiations with workers on a new contract—are listed as business clients of Anderson Economic Group. The consultancy group also lists as clients “Auto dealers representing: Audi, BMW, Buick, Cadillac, Chevrolet, Chrysler, Dodge, Ferrari, Fiat, Ford, Genesis, GMC, Harley-Davidson, Honda, Hyundai, Jeep, Kia, Lamborghini, Lexus, Lincoln, Lotus, Mazda, Mercedes-Benz, MINI, Nissan, Porsche, Ram, Subaru, Suzuki, Toyota, Volkswagen, and Volvo brands.” These not only include Ford and GM models but brands in the Stellantis family (Chrysler, Fiat, Jeep).

This is a direct conflict of interest that should be disclosed by media outlets.

Asked whether Ford and General Motors directly commissioned this particular study, Lisa Wootton Booth, marketing and executive assistant for Anderson Economic Group, wrote over email, “We have previously done business with car manufacturers, auto dealers, and labor unions. However, no outside company or group was involved in the analysis you mention in any way. As experts in the automotive industry, we often produce studies like this internally and independently.” AEG’s labor clients include the Service Employees International Union, but not the United Auto Workers. (Ford and GM also denied any involvement in the study.)

Yet, even if, as AEG claims, Ford and General Motors did not pay for this particular study, the fact that these companies are counted among the consultancy group’s clients, alongside a bevy of auto companies, is cause for concern. AEG may very well understand that the key to securing its long list of clients in the auto industry is to produce content that tilts in their favor. Any incoming money from Ford or General Motors, whether or not it was specifically earmarked for this study, is relevant to broader concerns about conflicts of interest. Furthermore, when headlines and articles reference a “study,” this gives the impression that a scholarly or neutral body conducted an above-the-fray review—not that an entity produced a study that intersects with the interests of two of its direct clients.

This is not the first time Anderson Economic Group has raised the alarm about the “costs” of strikes. On July 14, AEG warned that “Potential UPS Strike Could Be Costliest in a Century.”

Such figures do not dominate headlines by accident. Companies have sophisticated apparatuses for public relations and media spin, and they have access to an array of consultancy organizations and think tanks which produce studies that tilt things in a particular direction. There is a reason this consultancy group is not releasing studies about the urgency of a just transition for electric-vehicle workers, the elimination of wage and benefits tiers, the right to strike over the closure of plants and factories, the restoration of cost-of-living adjustments, and improved paid time off—all things the UAW is calling for.

Strikes are expensive for the employer, and that is precisely the point. CEOs and shareholders of General Motors and Stellantis are talking to each other on their earnings calls about the high costs of a potential strike. According to the calculations of the UAW, the Big Three made a combined $21 billion in profits in the first six months of this year. If these companies are so concerned about the costs of a strike, there is certainly a deep well of profits they could draw from to offset the costs to the auto industry and to workers.

Through the collective will to withhold their labor and cost their employers money, workers have not only improved their own lot but won broad social gains, like the eight-hour workday and safer nurse-to-patient staffing ratios. If you believe that employers fail to pay workers for the full value they produce, then you see no moral problem at all with a strike being expensive. And given that the strike is the main tool workers have to improve their conditions, it’s reasonable to believe the social benefits outweigh the immediate hardship and sacrifice required to pull off such a collective action.

Which is all to say, it’s not at all automatic that a strike being “expensive” is a bad thing, or that the “economy” is something that can be “harmed” in the abstract. What’s harmed in a strike is corporate profits, a harm that can end at any minute, when the companies, which have raked in those record profits, decide to negotiate in good faith and make concessions.

By contrast, the function of studies like this is less to teach the public about the role of the strike in building worker power and more to scare the public and win sentiment for corporate bosses. The media doesn’t have to help with this effort.